Some Known Factual Statements About Health Insurance In Toccoa Ga

Table of ContentsSome Ideas on Automobile Insurance In Toccoa Ga You Should KnowCommercial Insurance In Toccoa Ga Things To Know Before You Buy3 Easy Facts About Automobile Insurance In Toccoa Ga DescribedHow Annuities In Toccoa Ga can Save You Time, Stress, and Money.

A financial expert can likewise help you make a decision just how ideal to attain goals like conserving for your youngster's university education or paying off your debt. Although monetary consultants are not as well-versed in tax obligation regulation as an accountant might be, they can provide some assistance in the tax obligation preparation procedure.Some monetary advisors use estate preparation solutions to their clients. It's essential for financial consultants to remain up to date with the market, financial problems and advising finest practices.

To offer financial investment items, consultants need to pass the relevant Financial Sector Regulatory Authority-administered tests such as the SIE or Series 6 tests to obtain their qualification. Advisors who desire to offer annuities or other insurance coverage products should have a state insurance coverage permit in the state in which they prepare to offer them.

Some Known Factual Statements About Health Insurance In Toccoa Ga

You hire an advisor who bills you 0. Due to the fact that of the regular cost framework, several advisors will not function with clients who have under $1 million in possessions to be handled.

Financiers with smaller portfolios may look for out a monetary advisor that bills a per hour cost rather than a percentage of AUM. Per hour charges for advisors usually run between $200 and $400 an hour. The more complicated your monetary circumstance is, the even more time your advisor will need to dedicate to handling your properties, making it much more expensive.

Advisors are skilled experts that can assist you create a prepare for economic success and apply it. You might likewise consider reaching out to an expert if your personal economic scenarios have just recently come to be more complex. This can imply buying a home, marrying, having children or obtaining a large inheritance.

The Of Annuities In Toccoa Ga

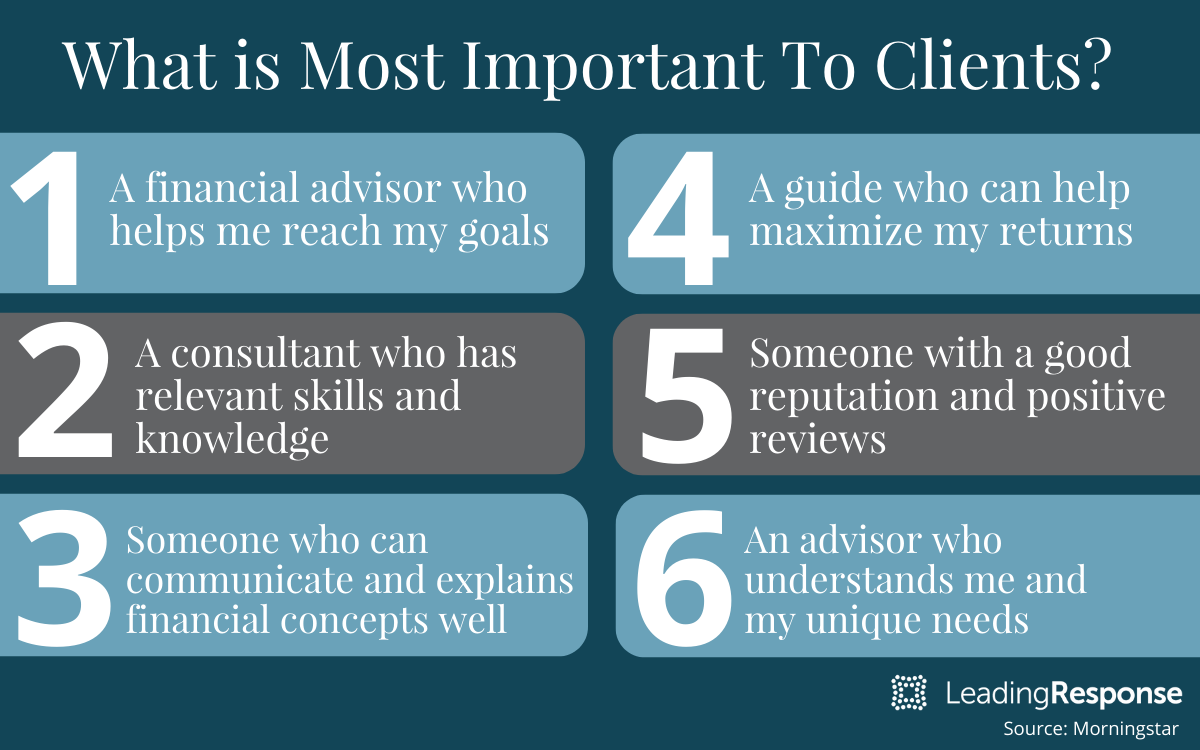

Prior to you satisfy with the advisor for an initial consultation, consider what services are most vital to you. You'll want to look for out an expert who has experience with the solutions you want.

What business were you in before you got into monetary suggesting? Will I be working with you straight or with an associate advisor? You may likewise want to look at some example monetary plans from the expert.

If all the samples you're given coincide or comparable, it might be an indicator that this advisor does not correctly customize their guidance for each and every customer. There are three major kinds of economic encouraging experts: Certified Monetary Organizer specialists, Chartered Financial Analysts and Personal Financial Specialists - https://businesslistingplus.com/profile/jstinsurance1/. The Qualified Financial Organizer professional (CFP expert) qualification indicates that an expert has actually fulfilled a professional and moral requirement set by the CFP Board

Examine This Report on Life Insurance In Toccoa Ga

When selecting a financial consultant, consider someone with a professional credential like a CFP or CFA - https://www.avitop.com/cs/members/jstinsurance1.aspx. You could additionally think about an expert that has experience in the services that are essential to you

These consultants are typically filled with problems of rate of interest they're much more salespeople than experts. That's why it's critical that you have an advisor who functions only in your benefit. If you're searching for an advisor that can genuinely offer real worth to you, it is very important to look into a number of potential alternatives, not simply pick the first name that advertises to you.

Currently, numerous experts need to act in your "benefit," yet what that entails can be nearly unenforceable, other than in one of the most egregious instances. You'll need to discover a real fiduciary. "The very first examination for an excellent financial advisor is if they are benefiting you, as your supporter," says Ed Slott, certified public accountant and founder of "That's what a fiduciary is, but everybody states that, so you'll require various other signs than the expert's say-so or even their credentials." Slott suggests that customers look to see whether consultants spend in their ongoing education and learning around tax planning for retired life cost savings such as 401(k) and individual retirement account accounts.

"They ought to prove it to you by revealing they have actually taken severe continuous training in retired life tax obligation and estate preparation," he claims. "You ought to not invest with any type of advisor that doesn't spend in their education.